How tax workflow automation helps governments disburse funding faster

Property taxes are critical to the finances of local governments. Collecting taxes and disbursing money to beneficiaries in the quickest way possible makes agencies more efficient and ensures the continuity of essential public services, such as funding schools.

A modern tax collection solution can help agencies increase online revenue, reduce manual work and accelerate disbursement. Uncover all the advantages SaaS workflow automation can bring to tax collector’s offices below.

Key takeaways:

- Government workflow automation software reduces the time associated with repetitive tasks and walk-in visits related to tax billing and collection and allows government staff to focus on other essential tasks.

- By minimizing manual payment processing and recollection, agencies can disburse funds more easily and quickly.

Advantages of workflow automation to government revenue management

With business process automation, repetitive tasks and manual workflows that require human intervention are automated. By following a rules-based model, the tax office workflow itself can trigger notifications, check information and request additional information. As a result, agencies benefit from:

- Fewer productive hours spent on manual tasks

- Increased tax revenue collection

- Quicker disbursement

How government workflow automation reduces the manual effort needed for tax billing and collection

While more basic informational workflows help citizens find the information they need, more complex workflows integrate with agencies’ back-end systems of record to look up data about a specific user. In both cases, agencies benefit from reduced calls and in-person visits for the staff to handle.

Consider a resident who wants to pay local property tax online. When citizens can look up their own account or bill and take immediate action, there is no need for government workers to manually:

- Verify account balances

- Ensure all records are correct

- Update the system of record

- Mark bills as paid

- Provide receipts

This type of process automation enables agencies to shift employees to other value-added activities, boosting not only productivity but also staff morale.

A government tax processing solution with workflow automation also helps minimize human errors associated with manually updating databases. With electronic payments, the process of balance reconciliation is automated. The information is correct when you get it, eliminating chargeback disputes.

Citizen payment solutions drive citizen engagement

With tax billing and collection software, citizens can enroll in electronic payments. This convenience cuts down costs associated with mailing bills and processing payments. It also means fewer walk-in visits, a lower volume of paper checks and reduced reconciliation efforts.

When Forrester Research conducted a Total Economic Impact™ (TEI) study to evaluate the potential return on investment (ROI) of deploying PayIt’s digital services and payments, they found that agencies saved $316,806 through increased productivity from the reduction of both document and payment processing.

E-billing also helps reduce payment delinquency because citizens can get reminders about their bills or set up automatic payments. With PayIt’s digital wallet, residents can even divide large bills into smaller, partial payments that fit within their budgets—reducing delinquency and late fees and helping residents keep money in their pockets.

Property tax collection software accelerates the community funding cycle

Data from the 2021 State of Cities report by the National League of Cities (NLC) highlights the importance of finding ways to reduce delinquency and modernize back-end processes. Steadier revenue collection accelerates the community funding cycle.

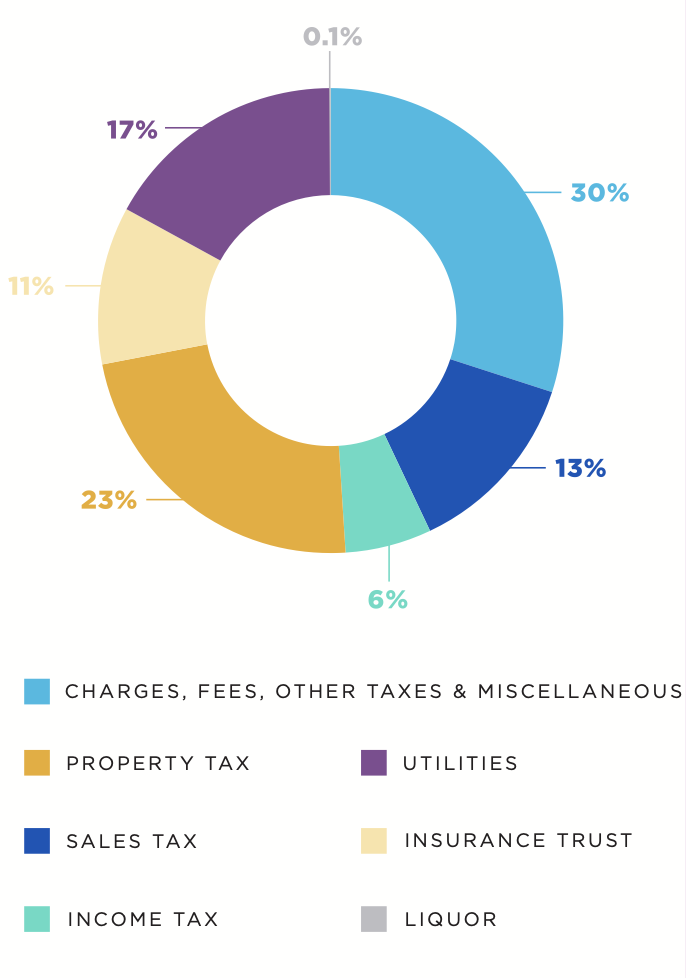

How much tax revenue does the government collect?

According to the State of Cities report, total municipal revenue collection reaches about $650 million from sources that include taxes, service fees, utilities and intergovernmental aid. Property and income tax account for 29% of municipal funds, as indicated in the chart below.

Source: 2021 State of Cities report

The National League of Cities’ 2021 report adds that “41% of municipalities saw a decrease in their total general fund revenues.” This data reflects the impact of the pandemic on municipalities’ finances. Even though residential property tax collections have not been significantly impacted, according to officials, there was a reduction in income taxes and fees collected, such as utilities and parking fees.

Streamlining the billing and collection process with tax automation software is critical to navigating these times of uncertainty.

Municipal revenue has a broader impact on the community, too. With earnings and property tax billing software, agencies can disburse funding more efficiently and better support services that citizens utilize on a daily basis. Consider the success story of the city of St. Louis, where:

- Income taxes generate about $240 million a year and go directly to the city’s general revenue, funding the police, the fire department, parks, and services such as tree trimming and fixing potholes.

- About 62% of real estate and personal property taxes benefit the St. Louis Public School System. This type of revenue also funds 14 different agencies throughout the city.

Gregory F.X. Daly, Collector of Revenue of the City of St. Louis, emphasizes the importance of quick revenue collection and disbursement to the city. “If we do not get the St. Louis Board of Education the money they need in a specific period of time, they will not be able to budget for some of the necessary things they need to do for our kids.”

PayIt’s tax collection solution has made this process easier for the city of St. Louis, freeing up employees’ time from manual tasks associated with payment reconciliation.

“PayIt has given us the ability to make sure that taxpayers’ dollars are going where they should be going the easiest way possible.”

— Gregory F.X. Daly, St. Louis Collector of Revenue

Streamlining processes with SaaS workflow automation

Local agencies can digitize property taxes, utility bills and other public services and payments with PayIt’s award-winning e-government software and services.

PayIt’s citizen payment solution offers government transactions in one secure, centralized platform. It’s not a one-size-fits-all approach, though. Agencies can personalize and scale their offerings based on their unique business needs, workflows and reporting requirements.

Built in the Amazon Web Services (AWS) GovCloud, the PayIt platform also helps the public sector meet security and regulatory requirements. PayIt is PCI Level 1 Merchant Provider and uses payment tokenization to prevent data breaches.

Digitize tax payments with PayIt

Increased online payments and reduced walk-in costs are among the many ways agencies can realize the return on investment (ROI) of tax billing and collection solutions. Explore all the other services and payments that your agency can digitize with PayIt’s software for government. Book a demo now.

Looking for more content?

Get articles and insights from our monthly newsletter.