Why you should take your property tax solutions to the cloud

Property taxes account for 17% of local government revenue, according to a survey conducted by the U.S. Census Bureau. Optimizing the process of collecting property taxes ensures efficient government funding and provides resources to cater to the community’s needs.

Transitioning to a cloud-based tax collection system centralizes data and simplifies payment processes. This capability allows every state’s tax department to provide a better experience for residents.

Key takeaways:

- Improving accessibility for constituents to carry out duties such as paying property taxes can significantly increase compliance.

- Property tax management software not only provides convenience for residents but also gives room for scalability and higher revenue for the government.

- A streamlined platform can help government agencies create an ecosystem of payments to manage from a consolidated dashboard.

Benefits of a property tax cloud solution

Government agencies increase cybersecurity resilience with the zero-trust security model.

Replacing legacy solutions with more modern cloud technologies is one of the top digital government transformation trends. According to Gartner, over 50% of government agencies will have modernized their main legacy applications by 2025.

In addition to providing increased security and scalability, here are some of the ways a property tax cloud solution benefits your jurisdiction:

- Breaking down silos with integrated reporting

- Reducing IT systems maintenance

- Improving residents’ experience with swift and user-friendly features

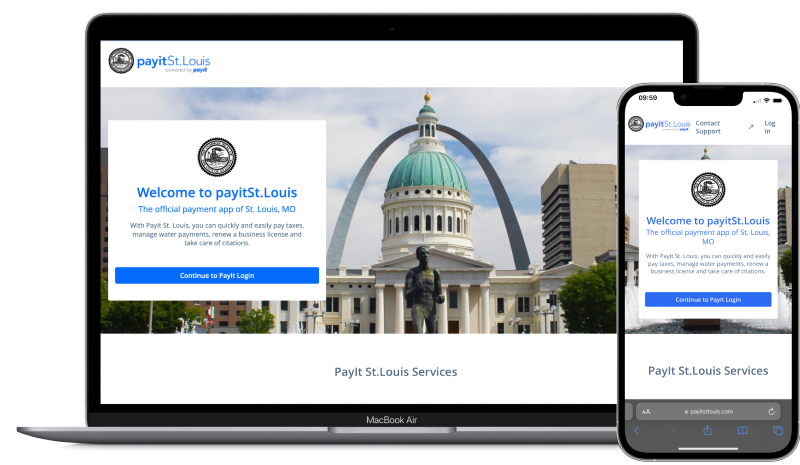

The City of St. Louis has been a frontrunner in digital government transformation since launching a payment solution that provides a full, end-to-end experience for every user through a partnership with PayIt.

St. Louis residents store all information regarding property tax transactions, track payment due dates, create a secure wallet and set up recurring payments with PayIt’s digital platform. This GovTech solution helps constituents save time visiting tax collector offices and allows the government to automate revenue generation.

What does the adoption of a property tax management software look like?

A 2021 survey by the National Association of State Chief Information Officers (NASCIO) revealed that the need to provide better online experiences for citizens drives 74% of government digital service expansion.

Working closely with your in-house specialists, PayIt integrates with your infrastructure in as little as 90 days of partnership and gathers relevant siloed data stored in systems across multiple agencies. This data management feature allows your team to save time re-entering data.

Our GovCloud experts then introduce you to your new data setup, a secure payment processing solution that enables your constituents to pay their property tax bills and other municipal fees, such as those related to utilities.

Other functions your constituents can enjoy with a real estate and personal property tax software solution include:

- Payment methods. Property owners can select their preferred payment methods from their GovWallet™.

- Account management. Constituents can link multiple properties to one account for convenient online payments.

- Payment plans. Homeowners can pay property taxes in installments and complete payments before the tax deadline. This capability reduces financial pressure on residents, creates a better user experience and increases constituent collection rates.

- Document access. Residents can access digital versions of their transaction history and other documents within your property tax software solution.

PayIt offers a low-code solution that connects to your department’s existing back-office record systems via API or flat-file integrations. This means that government agencies can customize property tax solutions based on their needs without having to overhaul existing code. Similar to a drag-and-drop platform, your team can offer solutions to residents in record time.

Optimize your government workflows with efficient tax solutions

Government agencies are constantly on the lookout for ways to provide citizens with convenience, better experiences and efficiency. Transitioning to a cloud-based property tax solution contributes to government digital transformation.

PayIt focuses on helping government agencies achieve operational efficiency while streamlining processes through digital solutions.

Need more information about how PayIt can help your team digitize and automate government workflows? Book a demo with our team of experts today.

Frequently asked questions

Can I use one vendor for all government payments in my jurisdiction?

Yes, you can. PayIt can power an all-in-one solution that serves multiple purposes for your jurisdiction. For example, you can receive payment for property taxes, water, refuse, motor vehicle registrations and other services on one platform.

What kind of integration capabilities can PayIt provide?

PayIt integrates with back-office systems through REST APIs, flat-file exchanges or SOAP APIs to create government IT solutions based on your agency’s specifications, branding and goals.

How can PayIt help your department combine scalability with a citizen-centered experience?

PayIt’s technology is nimble and flexible, allowing government agencies to expand services and improve the citizen experience. By adopting modern cloud-native technology and prioritizing a user-friendly experience, PayIt customizes solutions to suit your department’s business workflows.

Looking for more content?

Get articles and insights from our monthly newsletter.